A committed tax management to achieve success for businesses and their leaders

Customized tax advice

Strong and practical tax defense

STEBLER AVOCAT law firm vigorously defends the rights and protects the reputation of its clients during tax audits and litigation. Withits lawyers’ expertise, the firm successfully manages relationships with French tax authorities and disputes before courts.

by carefully considering the specificities of your situation.

Founder of the firm, Philippe STEBLER is an attorney-at-law at the Paris bar and a member of the Institute of Fiscal Counsel Lawyers (Institut des Avocats Conseils Fiscaux). He gained his experience working for a decade in a large law firm, and fosters entrepreneurship as an essential part of his culture.

He holds a LL.M. degree in International Tax Law from King’s College London. Regularly invited to speak at universities and law schools, notably with respect to directors’ tax environment, he also frequently contributes to academic journals.

Lately, tax incentives have been boosted in France but taxpayers also face an intensification of fraud repression. It is therefore crucial to develop a tax strategy prioritizing security and efficiency.

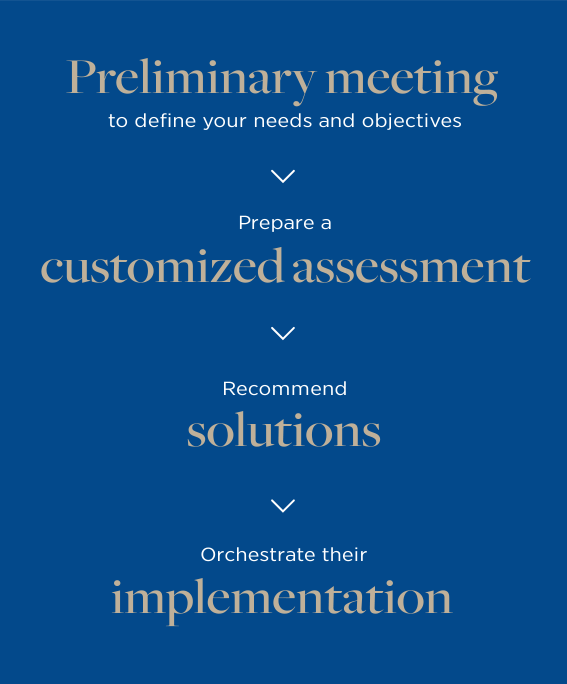

STEBLER AVOCAT law firm anticipates and masters tax exposures, identifying tax opportunities for your businessesand personal needs. The Tax Protection and Strategy adapts to your situation to develop a personalized plan with the following key steps:

By taking care of your tax issues with a clear and efficient strategy, your attention can be fully focused on the growth of your wealth and business.

Tax advice for individuals

- Business owners’ compensation package

- Incentive plans for managers

- Transfer of tax residence

- Ownership and transfer of professional and personal estates (gifts, inheritance, family buy-outs)

- Artists and art dealers

- Tax management of real estate

- Financial investments and crypto assets

- Philanthropy

- Annual tax returns (income tax, wealth tax, exit tax, trusts)

- International tax law (tax treaties, EU law)

Tax advice for businesses

- M&A transactions / Private equity

- International inbound or outbound development

- Complex and strategic operations

- Financial structure

- R&D

- Green and energy tax

- International mobility

- Management of tax affairs

Interactions with French tax authorities

- Responds to requests for information

- Assistance and representation from tax audit to litigation

- Criminal tax law

- Requests for tax ruling

- Non-contentious proceedings

- Partnership with the French tax authorities

- Spontaneous tax regularization (foreign bank accounts, etc.)